The 2018 meeting of the Society for NeuroEconomics was hosted over three days in early October by the Wharton School at the University of Philadelphia, Pennsylvania. As a warm-up to the main event, the Consumer Neuroscience Satellite Symposium is another increasingly popular platform for scientific communication and exchange the day before the start of the main conference. A few of us – Sebastian Gluth, Regina Weilbächer, Peter Krämer, Laura Fontanesi, Loreen Tisdall – made the trip to the US East Coast to attend the symposium and/or conference, and present some of the projects we are working on (see conference contributions below).

As in previous years, the conference featured topical sessions (e.g., ‘Intertemporal Decision Making and Self-Control’, ‘Valuation and Choice’), poster sessions, poster spotlights, workshops, the Fred Kavli Plenary Lecture (Alex Kacelnik, ‘Choice and value: The biology of decision making’), and of course plenty of opportunity to network. Interestingly, several workshops focused on big data and online testing: Robb Rutledge for example presented the Great Brain Experiment, an app that gamifies experiments on risk, memory, attention, and impulsivity and is allowing researcher to collect large datasets (n > 10,000).

Regrettably, very few talks focused on methodological issues in neuroeconomics. An exception was the best voted talk: “The space of decision models

” by Sudeep Bhatia. In this talk, Bathia presented a method to look at commonalities between the many proposed decision making models (he considered 157 of them), based on their explanatory power and complexity.

A very welcome break away from previous meetings was that quite a few talks were given by early career researchers. Anecdotally, we noticed a worrying trend, namely, that NeuroEconomists do not like apples: A number of talks focused on decisions that involved healthy but bad-tasting apples, versus unhealthy but yummy doughnuts. More data is needed to draw firm conclusions on the link between research topic and taste perception.

This year’s Cocktail Reception was hosted at the Penn Museum’s Egypt Gallery, where presumably the less formal atmosphere led to a wide range of discussions, including the (ethical) use of animals in research, the neural mechanisms underlying prosopagnosia, and individuals’ preferences for burial over cremation … something for everyone. The subsequent journey to the south side of town for famous Philly cheese steak, in contrast, was not for everyone, but an experience nevertheless.

Next year’s meeting will be in Dublin, Ireland, and we look forward to learning more about ongoing research in NeuroEconomics. As a direct outcome of the meeting, Laura and Loreen will join the ‘Neuroimaging Analysis Replication and Prediction Study’ … stay tuned for further details.

—- Blog post co-authored by Laura Fontanesi and Loreen Tisdall —-

Fontanesi, L., Gluth, S., Rieskamp, J., & Forstmann, B. (2018). The role of dopaminergic midbrain nuclei in predicting monetary gains and losses: Who’s doing what? Paper presented at the 16th annual meeting of the Society for NeuroEconomics, Philadelphia, PA.

Gluth, S., & Meiran, N. (2018). Linking trial-by-trial variability in computational models to neural data via Leave-One-Trial-Out (LOTO). Poster presented at the 16th annual meeting of the Society for NeuroEconomics, Philadelphia, PA.

Kraemer, P., Fontanesi, L., Spektor, M., & Gluth, S. (2018). How response time analysis aides model selection in memory-based decisions. Poster presented at the 16th annual meeting of the Society for NeuroEconomics, Philadelphia, PA.

Tisdall, L., Frey, R., Horn, A., Ostwald, D., Horvath, L., Pedroni, A., Blankenburg, F., Rieskamp, J., Hertwig, R., & Mata, R. (2018). The risky brain: Local morphometry and degree centrality as neural markers of psychometrically-derived risk preference factors. Poster presented at the 16th annual meeting of the Society for NeuroEconomics, Philadelphia, PA.

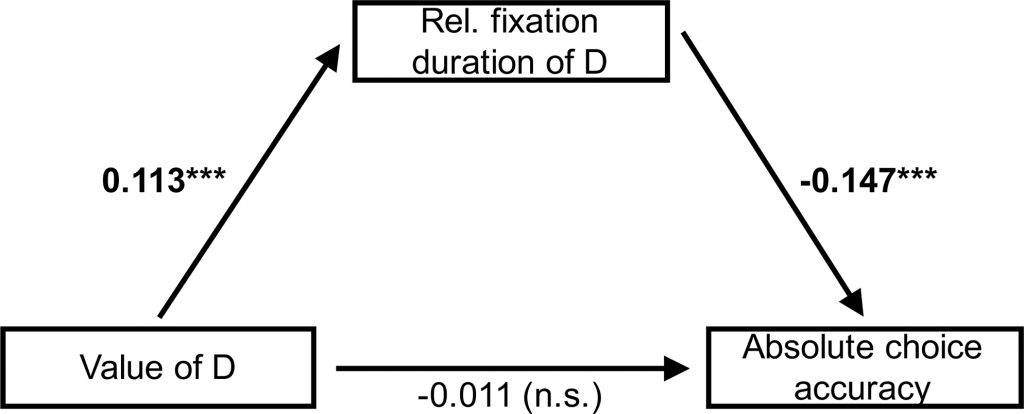

Weilbaecher, R., Rieskamp, J., Krajbich, I., & Gluth, S. (2018). Is attention mediating the memory bias in preferential choice? Poster presented at the 16th annual meeting of the Society for NeuroEconomics, Philadelphia, PA.