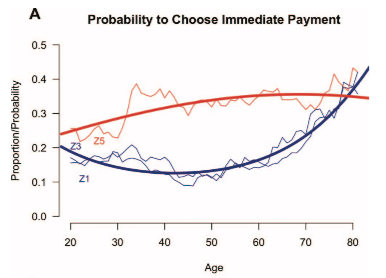

David Richter and I have a new paper out on age differences in intertemporal choice. We analyzed data from the German Socio-economic panel asking individuals between 18 and 96 years of age to decide between a smaller-sooner amount, say 200 EUR today, or a larger-later amount, say ca. 310 EUR in 1 year. Our results suggest (at least for longer delay conditions; the blue lines in the figure above) a weak U-shaped association between age and “patience”, with young and older adults being less patient (i.e., preferring the immediate payment more often) relative to middle-aged adults (the red line represents the effect for a 1-month delay). We conclude that future work needs to consider time horizon more closely when investigating the adult development of intertemporal choice (title, abstract, and reference below).

Age Differences in Intertemporal Choice: U-Shaped Associations in a Probability Sample of German Households

To describe adult age differences in intertemporal choice, we analyzed data from 1,491 participants who completed an incentivized monetary intertemporal discounting choice task involving different conditions (e.g., time delay of 12 months vs. 1 month). Respondents completed a number of other survey measures including behavioral measures of cognitive ability and self-reports concerning health, financial security, and demographic characteristics. We found significant quadratic (U-shaped) effects of age in task conditions involving 12-month (but not 1-month) delays, with middle-aged adults proving most patient relative to younger and older adults. The age effects found were robust to the inclusion of covariates, including cognitive ability, that have been suggested to underlie individual and age differences in time preferences. The results favor theories that propose nonlinear effects of age-related processes or multiple mechanisms underlying the development of intertemporal choice across the life span and suggest that it is important to consider long time delays and wide age ranges when trying to understand age differences in time preferences.